Comparing Traditional and Modern Investment Opportunities

In an ever-evolving monetary landscape, recognizing the differences in between contemporary and standard financial investment chances is necessary for capitalists aiming to maximize their profiles. Conventional financial investments, such as supplies and property, have actually long been the keystone of wide range buildup. Alternatively, contemporary financial investment methods, consisting of cryptocurrencies and peer-to-peer financing, have actually arised with the possible to redefine exactly how people come close to possession monitoring. By analyzing these 2 worlds, capitalists can make educated choices that straighten with their monetary objectives.

Overview of Investment Opportunities

Financial investment chances can be generally classified right into contemporary and standard kinds, each with its very own distinct characteristics and relevance. Conventional financial investments usually describe well-known monetary tools that have actually stood the examination of time. These consist of:.

- Stocks: Equity shares in openly traded firms.

- Bonds: Debt protections released by federal governments or firms.

- Real Estate: Physical residential properties that can create rental revenue or value in worth.

Modern financial investment chances, on the various other hand, describe a lot more current advancements in the monetary markets. They consist of:.

- Cryptocurrencies: Digital money that use blockchain modern technology.

- Peer-to-Peer Lending: Platforms that permit people to provide cash straight to others.

The historic context exposes that standard financial investments have actually been the key ways of wide range generation for centuries. On the other hand, contemporary financial investments are obtaining grip, especially amongst more youthful demographics that are attracted to their availability and possibility for high returns.

Characteristics of Traditional Investments

Conventional financial investments have a number of essential attributes that specify their nature:.

- Liquidity: Bonds and supplies can typically be dealt promptly on exchanges, making them fairly fluid properties.

- Regulation: These financial investments are greatly managed, offering a layer of safety for capitalists.

- Long-term Growth: Traditionally, supplies and property have actually revealed significant development over expanded durations, taking advantage of worsening returns.

Conventional financial investments come with incentives and dangers. The securities market can be unstable, and property financial investments need considerable resources and recurring monitoring. Availability is likewise an element; while bonds and supplies are commonly readily available, property typically demands significant in advance financial investment.

Characteristics of Modern Investments

Modern financial investments consist of cutting-edge monetary tools that utilize modern technology and existing distinct chances:.

- Cryptocurrencies: Digital properties like Bitcoin and Ethereum are decentralized and can be traded around the world.

- Peer-to-Peer Lending: This version links consumers straight with lending institutions, typically using greater returns than standard interest-bearing accounts.

- Robo-Advisors: Automated financial investment systems streamline the spending procedure, making it obtainable to a wider target market.

Technical improvements play an important duty in helping with these financial investments. The surge of blockchain modern technology and on the internet financing systems has actually changed exactly how people spend, minimizing obstacles and boosting possible returns. Contemporary financial investments are not without dangers, especially worrying market volatility and regulative unpredictability.

Investor Demographics and Preferences

The demographics of capitalists involving with standard financial investments usually consist of older, a lot more well-known people that prefer security and integrity. These capitalists typically have considerable resources to allot and are a lot more familiar with standard financial investment techniques.

Alternatively, there is an expanding pattern amongst more youthful people being attracted in the direction of contemporary financial investments. Millennial and Gen Z capitalists are especially drawn in to cryptocurrencies, seeing them as a way to accomplish monetary freedom and fast wide range buildup. Inspirations behind these options typically originate from a need for development and the possibility for greater returns, a plain comparison to the conventional nature of standard financial investment approaches.

Performance Metrics

Reviewing the efficiency of financial investments is crucial for both contemporary and standard rounds. Conventional financial investments count on metrics such as:.

- Total Return: The general roi, consisting of resources gains and rewards.

- Price-to-Earnings Ratio (P/E): An action of a firm’s existing share rate about its incomes per share.

Modern financial investments present extra metrics that mirror their distinct nature:.

- Market Capitalization: The complete market price of a cryptocurrency, typically a sign of its security.

- Annual Percentage Yield (APY): Used in peer-to-peer financing to gauge the yearly return on financial investment.

Relative historic information reveals that while standard financial investments have a tested performance history, contemporary financial investments can display fast development, though with greater volatility.

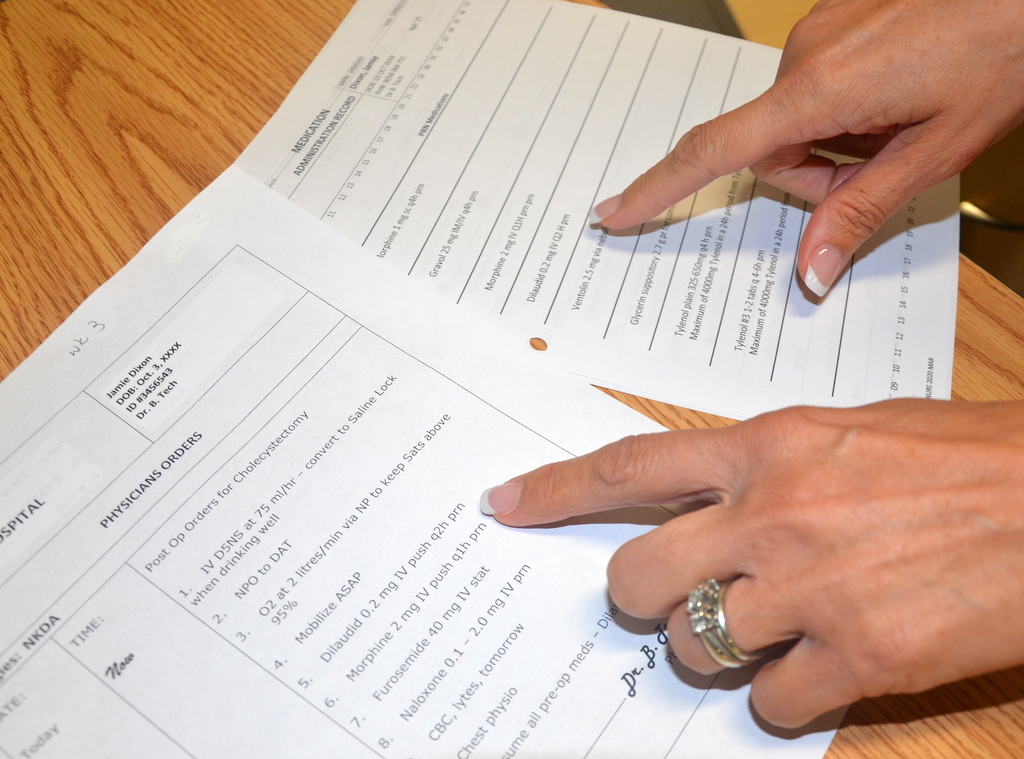

Regulatory Environment, Comparing contemporary and standard financial investment chances

Source: opentextbc.ca

The regulative structures controling standard financial investments are reputable and offer a complacency for capitalists. Governing bodies, such as the Securities and Exchange Commission (SEC), implement guidelines that secure capitalists from fraudulence and make sure market honesty.

On the other hand, the developing laws bordering contemporary financial investments, especially in the cryptocurrency market, mirror the difficulties of equaling fast technical modifications. Conformity for contemporary financial investments postures difficulties as a result of differing laws throughout territories, making it necessary for capitalists to remain notified.

Case Studies

Effective standard financial investment techniques can be exhibited with long-lasting supply financial investments in firms like Apple or Microsoft, which have actually given significant returns over the years. Prime actual estate financial investments in urban locations have actually continually valued, showing the incentives linked with standard approaches.

Modern financial investments, such as very early financial investments in Bitcoin or effective peer-to-peer financing systems like LendingClub, highlight the transformative possibility of cutting-edge techniques. Danger monitoring techniques vary; standard financial investments typically depend on diversity throughout possession courses, while contemporary financial investments might stress technical options and market evaluation to minimize dangers.

Future Trends in Investments

The landscape of standard financial investments is anticipated to develop with raised assimilation of modern technology, such as AI-driven evaluation and automated trading systems that boost decision-making procedures. Conventional properties might significantly take on electronic kinds, showing the expanding impact of modern technology in financing.

Arising patterns in contemporary financial investments consist of the surge of decentralized financing (DeFi) and the possible policy of cryptocurrencies, which might boost their authenticity and bring in even more conventional capitalists. As both financial investment worlds remain to establish, the merging of contemporary and standard techniques is most likely to improve the future of investing, promoting an extra comprehensive and vibrant monetary environment.